The Role of Gold in Optimal Portfolio Allocation

Let’s get technical, shall we?

For most people, starting a savings habit is an achievement in itself. But that’s only half the work done- how do you make sure that your savings are making you money, while also staying safe enough to be covered from market volatility or macroeconomic influences?

According to Modern Portfolio Theory, the answer lies in constructing your portfolio in a manner that can help you optimize returns while factoring in the risk from each type of product. Essentially, the assumption is that a rational investor would look for the highest risk-adjusted return.

Considering the upheavals to financial systems in the last 20 years, both traditional advisors and individual investors have been forced to re-evaluate approaches to risk management and consider new alternatives in portfolio construction.

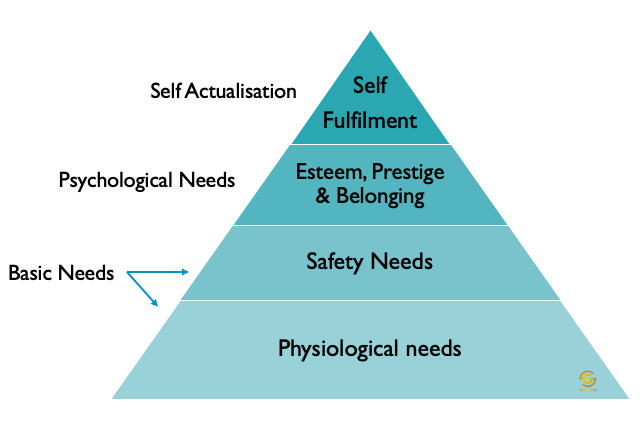

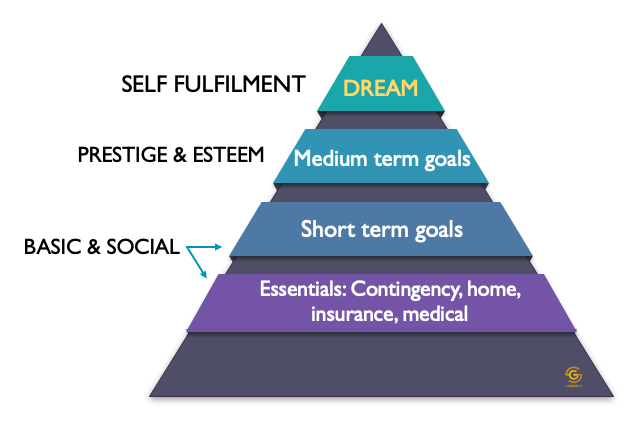

Prioritising Different Goals

Much like Maslow’s needs hierarchy, our investments can be prioritised based on the level of need they occupy. The essentials for sustenance- contingency funds, one’s home, medical needs, and the like.

The second level of psychological needs are those plans we are looking to fulfil in the medium term, which are good to have, but not essential for day-to-day living. This could be down payments for a house or car, planning for your child’s higher education or major travel.

Lastly, the dream bucket- saving for that spectacular early retirement, planning for a round-the-world cruise, or some other bucket list goal.

Map Your Investment Product to Your Goal

If we take this further, you can also map out the kind of investment that is suitable for each level. Your essentials must be formed out of a rock-solid plinth- i.e. assets that can withstand market shocks and, crucially, can be accessed or liquidated very quickly. This equates to having cash on hand, FDs, savings in a bank, or any other highly liquid asset.

Medium-term goals, which are usually 5–6 years away, are best served through SIPs in products that are conservative with risk, such as mutual funds. This takes care of your long-term wealth generation prospects. Forward-thinking and a strong belief in the power of compounding can take you a long way.

Finally, for that dream goal or bucket list item, where the horizon is more than 15–20 years away, you can afford to take bigger risks- direct equity or newer options such as angel investment in a start-up.

Going back to our initial thesis on risk-adjusted portfolio construction, the question becomes one on how to create a well-adjusted portfolio, that can help you participate in higher returns, while also ensuring your foundation never crumbles. To do this, a rational investor would ideally pick a mix of assets that perform differently across various scenarios, so that one investment can offset losses in another asset class. This is where gold can play a role.