The Definitive Guide to Buying Gold This Diwali- Part I

Gold is an Essential Part of Indian Tradition

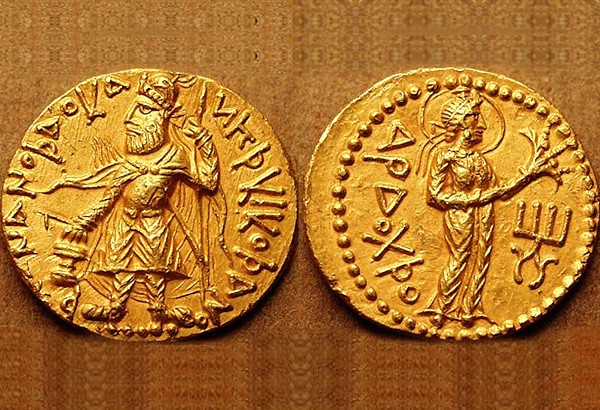

Whether it was the Kushans or the Indo-Greeks before them who first introduced gold coins to India, is a matter of debate. But what isn’t debatable is the love that Indian consumers have felt for the yellow metal in the millennia since, and the strong connection we feel between celebrations and gold.

This Diwali, Indian people will celebrate the victory of good over evil, but if you are considering buying gold, you’ll need to ensure a slightly different kind of victory.

An essential part of Indian tradition, buying gold is the norm on auspicious days like Makar Sakranti, Gudi Padwa, Navratri, Dussehra, Akshaya Tritiya, Dhanteras, Diwali, etc. as it is believed to lead to wealth and prosperity. Unfortunately, however, people buy jewellery, gold coins, biscuits and more on Dhanteras, without taking enough care to focus on important details like price and quality at times — such is the pulling power of gold.

Here are some simple ways by which you can make sure you know what you’re getting from any physical gold purchase.

Know Your Gold

How to Evaluate Physical Gold:

There are a few different types of gold available and these should ideally be considered in your decision-making criteria keeping in mind purity, quality and price. You should know what you’re getting!

Pure 24-karat gold is soft, so it’s used primarily to make less intricate objects and the most common way to buy it is in the form of gold coins, bars and biscuits.

Gold jewellery, on the other hand, is made by adding other metals like silver, copper, nickel and zinc to give it durability. Jewellery is usually 22, 18 and 14-karat.

If you examine your gold, you’ll often find that purity is displayed numerically, and these numbers correspond to the percentage of purity. This is called the Fineness Number. So, for example, 995 or upwards corresponds to 24K gold, 916 corresponds to 22K gold, 750 corresponds to 18K gold, and so forth.

Gold bought purely for investment should be of 24K since you stand to gain the most over time if the gold content has not been diluted. Of course, many people choose to combine both needs- adornment and investment- into a single piece.

How to Check your Karats:

The marking of karat value is mandatory on each piece of jewellery, called ‘Hallmarking’. The Government of India set up the Bureau of Indian Standards (BIS) to ensure that consumers get what they pay for and so they certify gold coins and jewellery by stamping it (embossing its mark on the gold item) to certify the level of purity of the item. However, coins and bars will often carry the mark of the Assay Certifier, a government-mandated institution that tests the coin or bar for purity standards and content.

Depending on what you’re buying- jewellery or coin- look for:

- BIS Logo (on jewellery)

- The purity of Gold (usually displayed as the Fineness Number, eg. 995, 999, 916, etc.)

- Logo of Assaying centre

- Jewellers’ Identification Mark and Number (on jewellery)

Making Charges on Jewellery

The price of gold jewellery is based on the purity of the gold, the mix of alloys used, and by the amount of skill and labour that goes into it (referred to as the making charge) — this can often carry a charge of 10–25% or more, especially for jewellery with stones. Since these charges typically vary from jeweller to jeweller, it’s possible you might be able to bargain a little, but you should also know that BIS Hallmarked Jewellery will carry a higher making charge than non-branded gold.

This is one of the areas in which bullion- i.e. coins and bars- wins out over jewellery from an investment perspective. From an investment perspective, gold coins are more beneficial to investment-focused consumers because the making charge for the coin is far lower than the cost of making jewellery.

The Importance of Receipts

Regardless of how trustworthy you feel your source is, take the bill from the jeweller or gold provider, for each gold item you’ve bought. Official proof of purchase and quality should never be negotiable so don’t fall for the ‘save on taxes’ trick from anyone (GST is just 3%).

- The bill should mention the purity of gold, its net weight and the rate of gold.

- In case of jewellery, it should also mention the hallmark and making charge.

- Don’t forget that in the case of theft or loss during travel, you cannot make successful insurance/police claims without proof of purchase. Getting a receipt isn’t just the law, it’s to ensure you’re not being penny-wise and pound-foolish.

Checked the Return Policy?

Often people buy gold on Dhanteras and then have second thoughts if it wasn’t what they truly wanted, the family didn’t like it, etc. It’s auspicious to buy gold, but just make sure that it’s not the wrong item for you. Buyback rates and return policies, especially for the making charge component, differs across jewellers, and you may lose some money if trying to resell/ return the item. This is especially true for studded jewellery where you may even pay a premium for the stones, but at the time of resale, won’t get back the full price (unlike the gold component).

Alternatively, if you’ve bought Digital Gold, you have an easier route as your gold is always reflected in your virtual balance/ wallet, where you can sell it at any time at prevailing market rates. This serves the gold-buying purpose, while also retaining your flexibility for when and in what form you would like to convert it into physical gold through coins or with jewellers.

Lower Buyback Rates

As an aside, you might have wondered why buying physical jewellery from jeweller ABC get a lower resale amount when you sell the same item back to jeweller XYZ. This is because XYZ will only pay you for the gold and not the making charges, administrative costs, profit margins, etc. you have already paid for when originally buying the gold. So unless it’s a piece you really love, watch out for hidden resale costs.

Ready to make your investment?

So now that you know your carrots from your Karats, you’re certainly ready to walk into a jeweller’s shop for a confident purchase, but have you considered your other options? Gold comes in many different shapes and forms, including bullion, jewellery, or even paper (in the form of gold funds or bonds).

There’s a multitude of options, but when it’s time to evaluate what kind of gold works best for you, you need to keep some crucial factors in mind for your decision. To help you out, we take you through your choices, and how to decide, in Part II of our Guide.