Tracking Gold – 2020 and Beyond

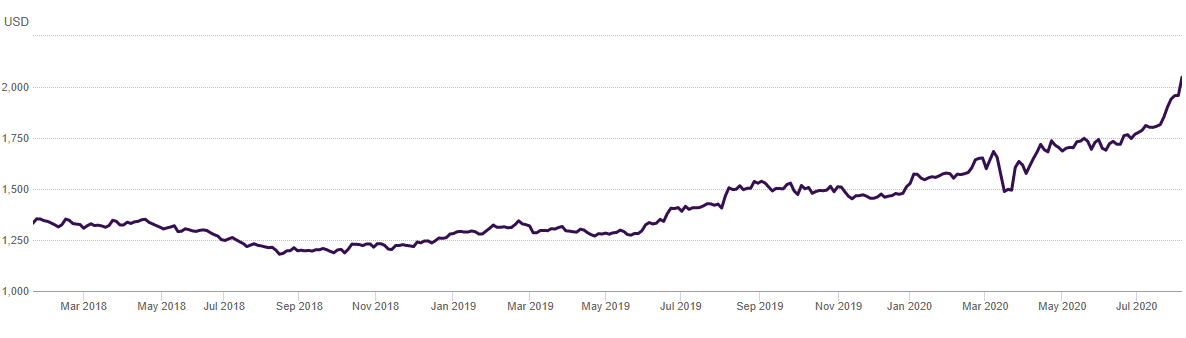

Gold has had a remarkable performance in the first half of 2020, significantly outperforming other major asset classes. Though equity markets around the world rebounded sharply from their Q1 lows, the high level of uncertainty surrounding the COVID-19 pandemic, the ultra-low interest rate environment, rising geopolitical tensions and increased central bank activities have led to an unprecedented demand for the yellow metal.

Increased Central Bank Buying:

A recent survey conducted by the World Gold Council of central banks noted that 20% of central banks intend to increase their gold reserves over the next 12 months, compared with just 8% of respondents in the 2019 survey. This shift suggests a re-evaluation of gold’s role amidst the ongoing financial and economic uncertainty, reflecting long-term concerns about fiscal sustainability as government stimulus is deployed to support the global economy. The move comes on the back of increased buying in 2019- itself an unusual year that saw a rush to safe haven assets due to trade wars and a global economic slowdown.

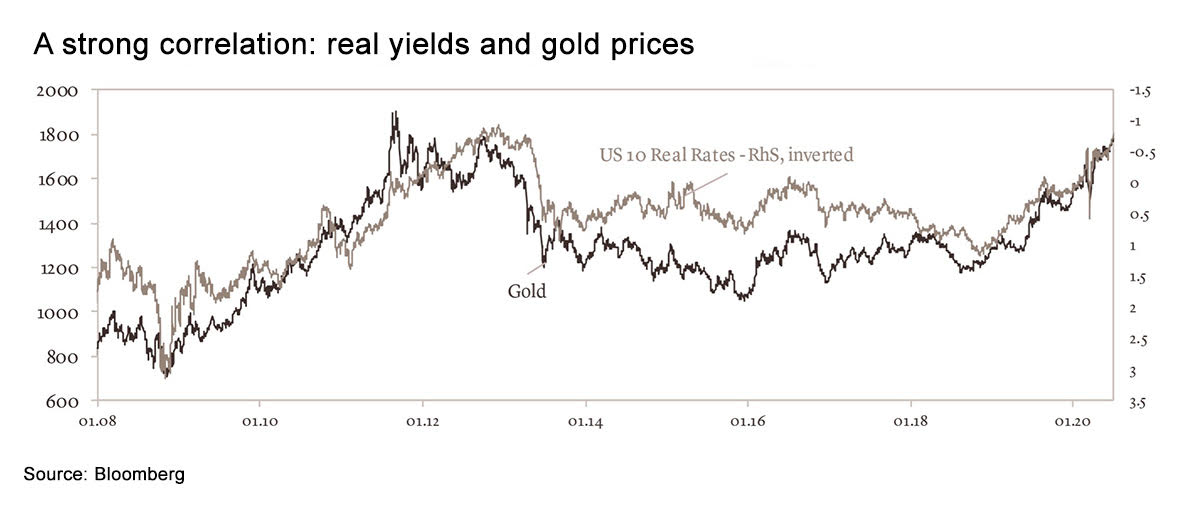

Falling Interest Rates:

The increased volatility in economic factors, coupled with the latest covid pandemic, have resulted in a drastic fall in government bond yields. In response to the pandemic, several central banks in developed countries reduced interest rates to close to zero or even went negative (eg. ECB, Japan, Switzerland, Denmark and Sweden). At the same time, concerted expansionary policy measures and asset purchases by global governments and central banks have kept interest rates at historically low levels. This has the dual impact of reducing the opportunity cost of holding gold, while supporting the case for gold as an inflation-hedge among investors focused on the possible inflationary implications of ballooning government debt. Almost 25% of the investment grade debt in the world currently carries sub zero yields, as of the second half of 2020.

As the interest rates fall below 0 into the negative territory (right), gold prices start testing levels of $1800+2000 per ounce (left)

Increased Institutional Buying:

The first half of 2020 saw record inflows of 734 tonnes into Gold Exchange Traded Funds- worth around USD 39.5 billion- a 600% increase from the same period a year ago and more than any full-year period in history, according to World Gold Council data. Further there has been a continued shift in the outlook towards gold globally, in part due to gold becoming an active investment allocation strategy apart from regular equity and debt investing. The global investment demand in the first half of 2020 hit an all time high of 1130 tons reaffirming the changed outlook towards gold.

Geopolitical Tensions:

If the last 2-3 years have taught us something, then it is about the rise of China and the increasingly ambitious strategy it has plotted out on a global stage. Already in the midst of trade wars with the US and then Australia, territorial disputes with India in the Himalayas, and with other countries in the South China sea of late, have only added to the fallout from China’s increasingly aggressive geopolitical strategy. As the dragon asserts its power globally and challenges the uni-polar US dominated world order that the world has become used over the last 3 decades, the equity and debt market will continue to remain volatile.

Move Towards Protectionism:

The Brexit referendum, followed by the results of the US election in 2016, effectively kicked off a global move towards protectionism. Amidst a growing tide of calls from nationalists in Italy and other European nations to exit the EU, the US has also consolidated its move to a more insular economic policy through curbs on immigration and tariffs on goods imported from China. India itself has started a critical evaluation of its supply chain dependencies and is actively pushing its “Make in India” policy. Such major changes could exert a downwards pressure on capital markets, in turn pushing investors towards a safer bet such as gold.

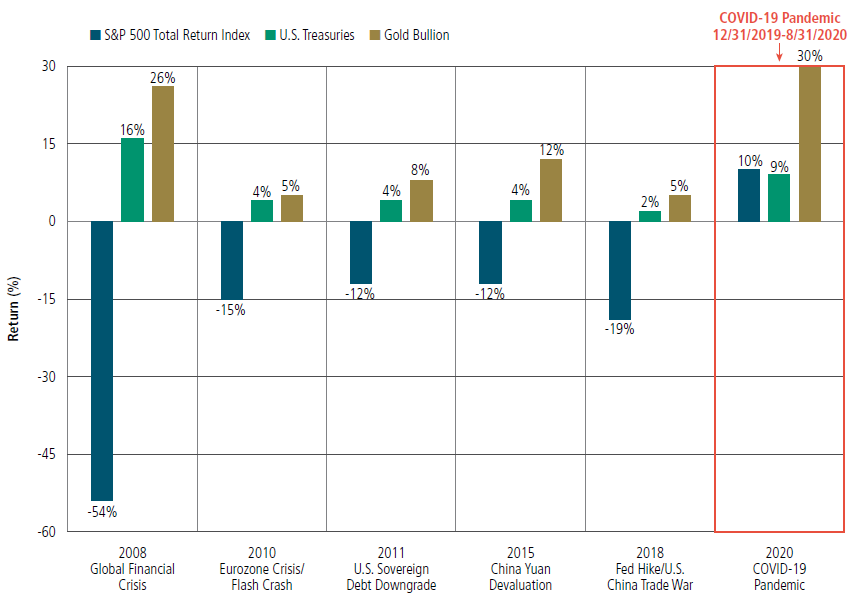

Performance of Gold Bullion vs. S&P 500 Total Return Index and U.S. Treasuries in “Crisis” Periods (2007-August 31, 2020)

In these circumstances, while a low to negative yield environment persists, especially in conjunction with a sluggish recovery, the financial demand for gold is expected to remain strong. This is further bolstered by any expected decline in the US Dollar, which could provide even more fuel for gold’s bull market, and in fact, recent reports by the Bank of America even make the case for gold reaching $3000 in the next 18 months. With strong headwinds pushing gold upwards, it remains an opportune moment for investors to aim for gold.

Leading gold analyst, Jan Nieuwenhuijs talks to SafeGold about why he thinks it’s highly likely for gold to cross $5000/oz in the next 5 years. Watch here!